Introduction

Really Impacts Your FICO Score: What Really Impacts Your FICO Score? Ever wondered why your FICO score keeps changing? Or why someone with a high salary can still have a lower score than someone who earns less? The truth is — your FICO score isn’t about how much you make. It’s about how you manage your credit. Let’s break it down in simple terms and uncover the real secrets behind your credit score.

Understanding the Basics of FICO Scores

What Is a FICO Score?

A FICO score is a three-digit number ranging between 300 and 850 that lenders use to judge your creditworthiness. It predicts how likely you are to repay loans on time.

Why Your FICO Score Matters

Your credit score impacts:

- Loan approval rates

- Interest rates on mortgages/car loans

- Credit card limits

- Renting an apartment

- Even job opportunities in some industries

FICO vs. Other Credit Score Models

While several scoring models exist, FICO is used in over 90% of lending decisions. So understanding it gives you a real advantage when dealing with banks.

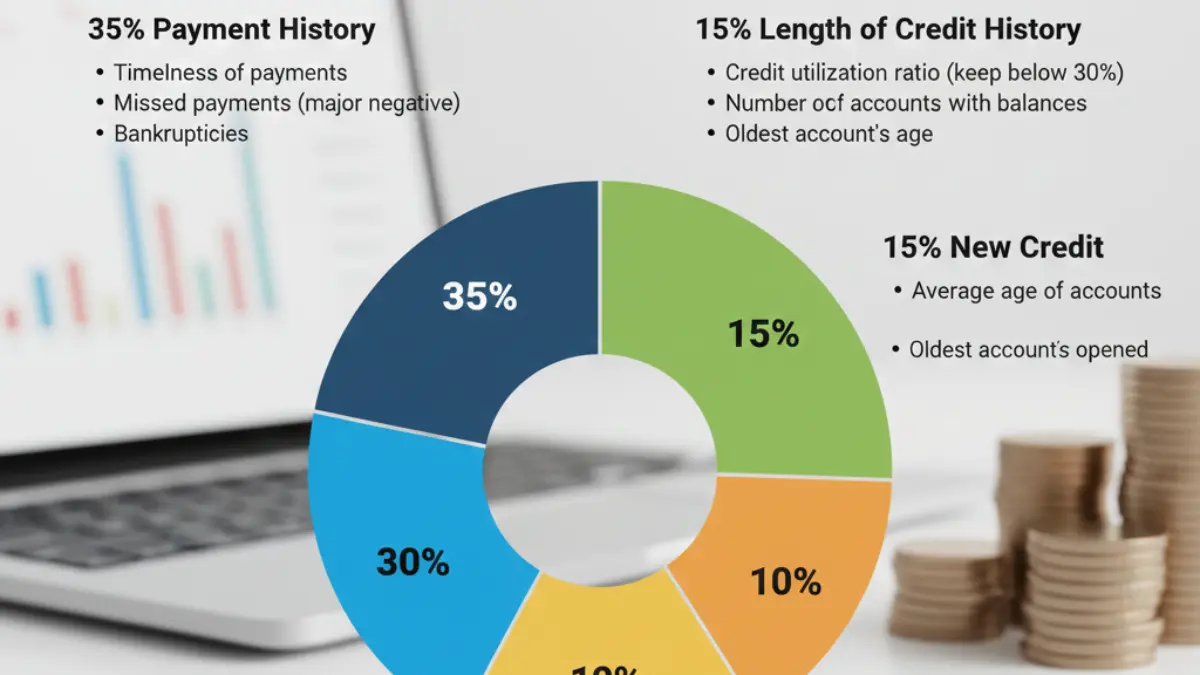

The Five Major Factors That Influence Your FICO Score

| Factor | Weight |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| New Credit | 10% |

| Types of Credit | 10% |

Payment History (35%)

Your track record of paying on time matters the most. Even one missed payment can stay on your credit report for up to 7 years.

Credit Utilization Ratio (30%)

This is the percentage of your credit that you use. If your limit is $5,000 and you use $4,000, that’s 80% — too high! Experts recommend staying below 30%. Under 10% is even better.

Length of Credit History (15%)

The longer you’ve had credit accounts, the better. That’s why closing old accounts can hurt your score.

New Credit & Inquiries (10%)

Too many credit card applications in a short time can bring your score down due to hard inquiries.

Types of Credit Used (10%)

A healthy mix of revolving credit (credit cards) and installment loans (car, mortgage, student loans) helps boost your score.

Deep Dive into Each Credit Factor

Late Payments – How Much Do They Hurt?

A single 30-day late payment can drop your score by 60–100 points. After 90 days, things get worse — lenders start seeing you as risky.

Ideal Credit Usage Percentage

Keeping your credit utilization between 10% and 30% is the sweet spot. Anything over 50% sends a red flag to lenders.

Why Older Accounts Are Golden

The longer your accounts stay active, the more trustworthy you appear. This is why never rush to close a long-standing credit card, even if you don’t use it often.

Soft vs. Hard Inquiries

- Soft inquiry: Checking your own credit score — safe and doesn’t affect your rating.

- Hard inquiry: Bank or lender checks your score for a loan — slightly lowers your score for 6 to 12 months.

Installment vs. Revolving Credit

A good mix shows lenders you can handle different types of borrowing responsibly.

Misconceptions About FICO Scores

Does Checking Your Score Lower It?

No! Checking your own credit is a soft inquiry and doesn’t harm your score.

Do Income & Job Status Matter?

Surprisingly, no. Lenders may ask about income during applications, but your salary isn’t part of your FICO score.

Closing Old Cards – Good or Bad?

Bad idea — it shortens your credit history and raises your utilization ratio. Keep it open if possible.

How to Improve Your FICO Score Quickly

Easy Wins You Can Apply This Month

- Pay off small debts first

- Ask for a credit limit increase

- Set automatic payments

- Dispute errors in your credit report

Smart Use of Credit Cards

Using multiple cards with low balances is better than maxing out one. It keeps your utilization low and boosts trust.

Avoiding Common Mistakes

- Don’t pay late

- Don’t apply for multiple cards at once

- Don’t close old accounts

Long-Term Strategies to Maintain a High Score

Building Credit the Right Way

Start with a secured credit card if you’re new to credit. Use it wisely and always pay on time.

Credit Mix Planning

Having both installment and revolving credit builds credibility with lenders.

Responsible Borrowing Habits

Use credit like a loaded gun — powerful when used correctly, dangerous when abused.

Tools & Resources to Track Your Score

Best Free Credit Monitoring Tools

- Credit Karma

- Experian

- Mint

- AnnualCreditReport.com (Official free report)

How Often You Should Check Your Score

Once a month is ideal. It doesn’t hurt your score and keeps you alert.

Detecting Identity Theft Early

If you notice accounts you didn’t open, act fast. Freeze your credit and contact all major bureaus.

Final Thoughts – Why Credit Education Matters

Your FICO score isn’t just a number — it’s your financial reputation. Understanding it gives you control and power in the world of money. With the right strategies and discipline, anyone can build — or rebuild — a strong credit score.

FAQs

1. Is 700 a good FICO score?

Yes! A score above 700 is considered good and can unlock lower interest rates.

2. How fast can I improve my credit score?

You can see improvements in 30–60 days with the right strategies.

3. Do medical bills affect credit scores?

Yes — if they go unpaid and are sent to collections.

4. How long do late payments stay on my report?

Up to 7 years, but their effect decreases over time.

5. Does paying off debt increase my score?

Absolutely — especially if it lowers your utilization ratio below 30%.