Introduction

Managing money doesn’t have to feel overwhelming. With the right monthly budget template, USA households can easily keep track of income, cut unnecessary spending, and start saving consistently. Think of a budget template as your personal GPS—it tells your money exactly where to go each month.

Whether you’re trying to save for a home, clear debt, or simply gain control over your finances, a budget is the foundation of financial success. Let’s break it down step by step.

Introduction to Budgeting

Why Every Household Needs a Budget

Ever wondered where your money disappears by the end of the month? That’s what budgeting solves. A budget gives clarity, reduces stress, and helps you take control instead of reacting at the last minute.

How a Budget Template Simplifies Money Management

A template organizes everything—from income to expenses—in one place. No more guessing, no more chaos. It’s structured, clear, and easy to follow.

Understanding the Basics of a Monthly Budget

Income Tracking

This includes salaries, side hustles, government benefits, pensions, or any money entering your home.

Expense Categorization

Expenses fall into three main buckets:

Fixed Expenses

Bills that don’t change monthly like rent, mortgage, car payments, or insurance.

Variable Expenses

These fluctuate—groceries, utilities, fuel, childcare, etc.

Discretionary Spending

Dining out, entertainment, subscriptions, shopping—basically your lifestyle choices.

Key Elements of a Monthly Budget Template

Net Income Section

This shows how much money you actually have to spend after taxes.

Savings & Emergency Funds

Every budget should allocate money toward long-term financial security.

Debt Payments

Credit cards, student loans, auto loans—these should be clearly listed to track progress.

Sinking Funds

These are mini-savings accounts for future costs like holidays, gifts, car repairs, or annual insurance.

Popular Budgeting Methods Used in the USA

50/30/20 Rule

A simple formula:

- 50% needs

- 30% wants

- 20% savings or debt payments

Zero-Based Budgeting

Every dollar gets assigned a purpose—nothing left unaccounted for.

Envelope Method

Use physical or digital envelopes to limit overspending.

Pay-Yourself-First Budget

Savings comes first, and everything else adjusts accordingly.

Creating a Budget Template Step by Step

Step 1 — List All Income Sources

Include take-home pay, bonuses, freelance income, investment returns—everything.

Step 2 — Add Monthly Bills

Rent/mortgage, utilities, insurance, phone bill, internet, car payment.

Step 3 — Track Variable Costs

Groceries, gas, eating out, entertainment, kids’ needs.

Step 4 — Set Savings Goals

This can include emergency funds, retirement, college savings, or sinking funds.

Step 5 — Review & Adjust Monthly

Budgets aren’t static—they evolve based on life changes.

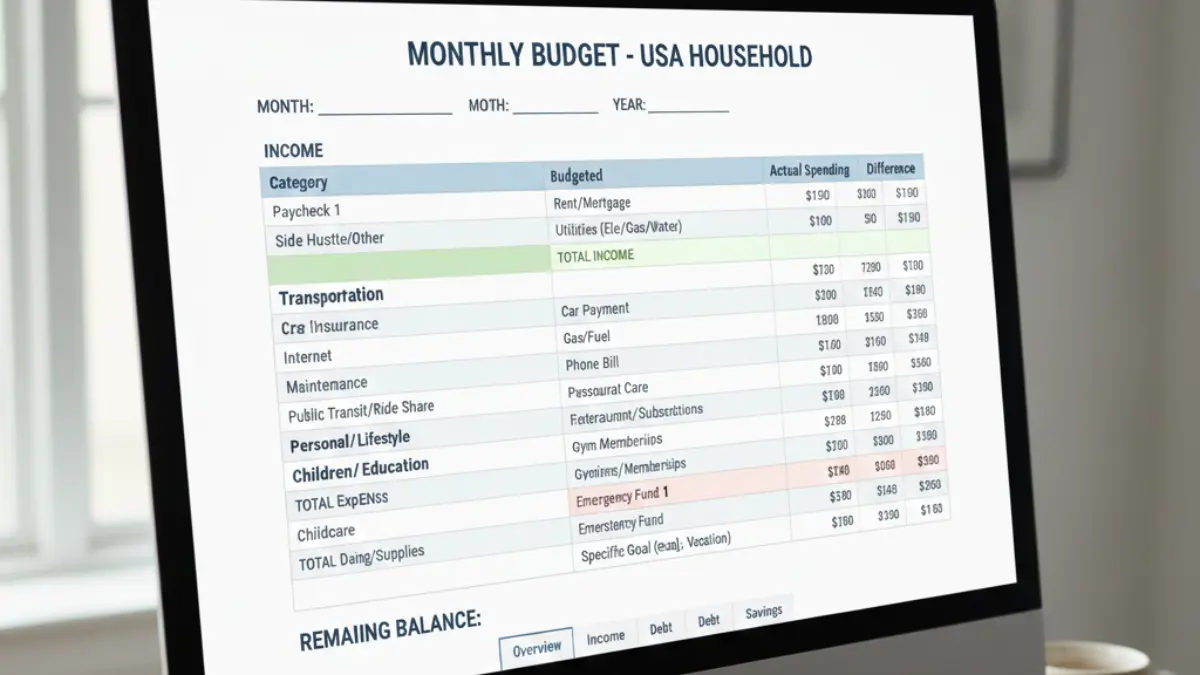

Sample Monthly Budget Template for USA Households

Income Table

| Income Source | Amount |

|---|---|

| Salary | $4,500 |

| Side Hustle | $600 |

| Other Income | $200 |

| Total | $5,300 |

Expense Breakdown Table

| Category | Budgeted | Actual |

|---|---|---|

| Rent/Mortgage | $1,400 | |

| Utilities | $250 | |

| Groceries | $500 | |

| Transportation | $300 | |

| Insurance | $350 | |

| Subscriptions | $80 | |

| Dining Out | $200 | |

| Entertainment | $150 | |

| Miscellaneous | $150 | |

| Total | $3,380 |

Savings & Debt Plan Table

| Type | Amount |

|---|---|

| Emergency Fund | $500 |

| 401(k)/IRA | $300 |

| Debt Payment | $400 |

| Sinking Funds | $200 |

Digital Tools & Apps for Budgeting

Best Free Tools

- Google Sheets

- Mint

- NerdWallet Budget Planner

Best Paid Apps

- YNAB (You Need A Budget)

- EveryDollar

- Monarch Money

Spreadsheet vs. App — Which Is Better?

Spreadsheets offer full control, while apps offer automation and ease. Choose based on your comfort level.

Tips to Stick to Your Monthly Budget

Automate Your Savings

Set recurring transfers so saving becomes effortless.

Monitor Your Spending Weekly

Small check-ins prevent overspending before it snowballs.

Why Overspending Happens & How to Avoid It

Impulse buying, emotional spending, and lack of planning are common culprits. Awareness helps break the cycle.

Common Budget Mistakes to Avoid

Forgetting Annual or Irregular Expenses

Think car registration, holidays, school fees—add these to sinking funds.

Not Reviewing the Budget Frequently

Reviewing keeps your budget aligned with real income and spending.

Underestimating Variable Expenses

Groceries and gas often cost more than expected—track them closely.

Benefits of Using a Monthly Budget Template

Reduces Financial Stress

Knowing where your money goes brings peace of mind.

Helps Build Savings Faster

Intentional saving leads to long-term financial strength.

Supports Long-Term Financial Goals

Whether it’s buying a home, starting a business, or retiring early—a budget is the road map.

Conclusion

A monthly budget template is more than just a document—it’s a lifestyle shift. It puts you in control, helps you reach your financial goals, and minimizes stress. When used consistently, it becomes one of the most powerful tools for financial freedom. Start simple, track honestly, and adjust as you go.

FAQs

1. What is the best budget template for beginners?

The 50/30/20 template is simple and easy for new budgeters.

2. How often should I update my monthly budget?

Review weekly and update at least once a month.

3. Should couples use one budget or separate budgets?

Joint expenses benefit from a shared budget, but personal budgets can still be separate.

4. What if my income changes each month?

Use your lowest expected income as a baseline to avoid shortfalls.

5. How can I make budgeting easier?

Automate bills, use digital tools, and create categories that match your lifestyle.