Introduction

Get Approved Americans for a Personal Loan: Getting approved for a personal loan in the U.S. may seem stressful, but the process becomes much easier when you know exactly what lenders look for. Whether you need funds for debt consolidation, medical bills, home improvements, or emergency expenses, personal loans can be a smart financial tool—if used correctly. This guide will break down everything Americans should know to increase their chances of getting approved fast and hassle-free.

Understanding Personal Loans in the USA

What Is a Personal Loan?

A personal loan is money borrowed from a lender that you repay over time with fixed monthly installments. The amount you can borrow usually ranges from $1,000 to $50,000 or more.

Types of Personal Loans

- Fixed-rate loans – predictable monthly payments

- Variable-rate loans – interest rate changes over time

- Debt consolidation loans

- Emergency loans

Secured vs Unsecured Personal Loans

- Unsecured Loans: No collateral; based only on creditworthiness.

- Secured Loans: Require collateral like a car or savings account, often easier to get approved.

Why Americans Apply for Personal Loans

Common Uses

People take personal loans for:

- Medical bills

- Credit card consolidation

- Home repairs

- Travel and education

- Emergency expenses

Benefits of Personal Loans

- Fixed interest rates

- Flexible repayment terms

- Can improve credit score when repaid on time

Eligibility Requirements for Americans

Credit Score Requirements

Most lenders prefer a score of 650+, but some accept lower scores.

Income and Employment Verification

You must show proof of stable income through:

- Pay stubs

- Tax returns

- Bank statements

Debt-to-Income Ratio (DTI)

Keep your DTI below 36% for better approval chances.

Age and Residency Criteria

You must be:

- At least 18 years old

- A U.S. citizen or permanent resident

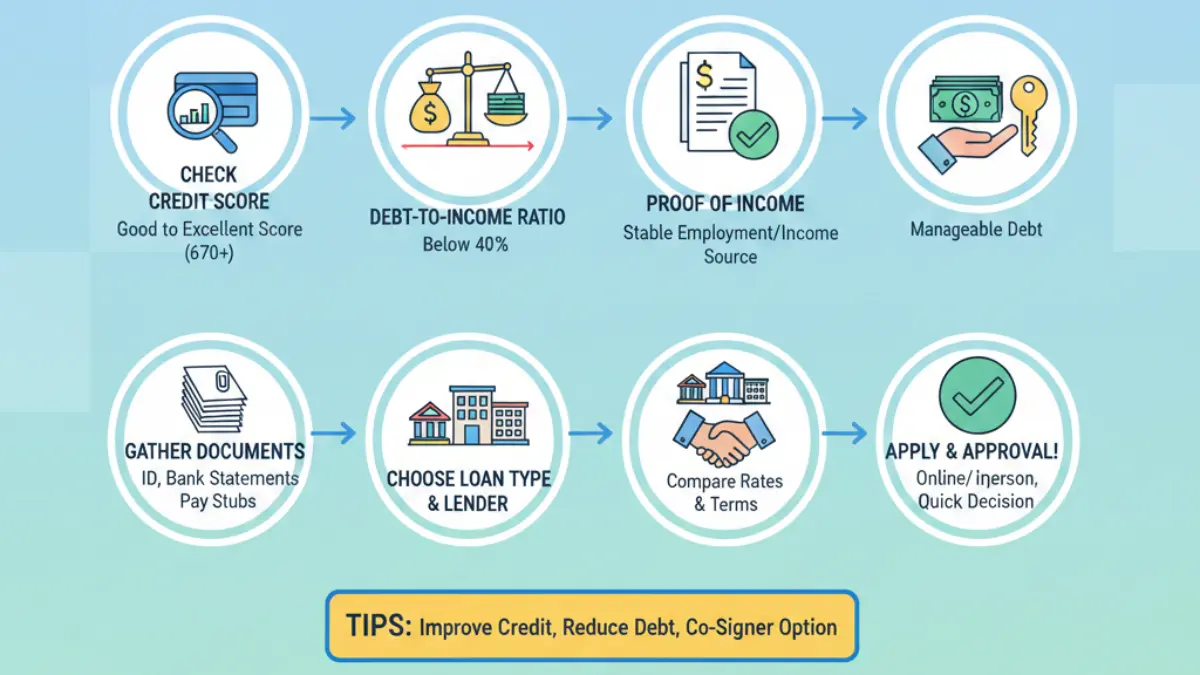

Step-by-Step Guide to Getting Approved for a Personal Loan

Step 1 – Check Your Credit Report

Look for errors and dispute any incorrect information.

Step 2 – Improve Your Credit Score

- Pay bills on time

- Reduce credit card balances

- Avoid opening new accounts

Step 3 – Calculate How Much You Can Borrow

Borrow only what you need to avoid unnecessary debt.

Step 4 – Compare Lenders and Loan Options

Check:

- Interest rates

- Fees

- Loan terms

- Reviews

Step 5 – Gather Required Documents

Most lenders require:

- Government ID

- Proof of income

- Bank account details

Step 6 – Submit Your Loan Application

You can apply online, making the process easier and faster.

Step 7 – Review and Accept Loan Terms

Read everything carefully: interest rate, fees, penalties, and repayment terms.

Where Americans Can Apply for a Personal Loan

Banks

Best for borrowers with strong credit.

Credit Unions

Lower interest rates and better customer service.

Online Lenders

Fast approval and flexible requirements.

Peer-to-Peer Platforms

Borrow money directly from investors.

Tips to Increase Your Approval Chances

Apply with a Co-Signer

A co-signer with good credit can boost approval.

Reduce Your Debt

Lowering your debt improves your DTI ratio.

Choose Longer Repayment Terms

Smaller monthly payments improve your overall affordability.

Avoid Multiple Loan Applications

Hard inquiries can harm your credit score.

Mistakes to Avoid When Applying

Ignoring Your Credit Score

This is one of the biggest factors lenders consider.

Borrowing More Than Needed

Higher amounts reduce your chances of approval.

Not Reading the Terms Carefully

Hidden fees and charges can surprise you later.

How Fast Americans Can Get Approved

Same-Day Loan Approval

Some online lenders approve loans instantly.

Approval Time for Different Lenders

- Banks: 1–7 days

- Credit Unions: 1–3 days

- Online lenders: Minutes to hours

Conclusion

Getting approved for a personal loan in the U.S. is absolutely possible when you understand what lenders want. Focus on your credit score, income stability, and debt levels to improve your chances. Compare lenders, prepare your documents, and apply confidently. With the right steps, you can secure the loan you need—without stress.

FAQs

1. Can I get a loan with bad credit in the USA?

Yes, some online lenders offer loans to borrowers with low credit, but expect higher interest rates.

2. What is the easiest loan to get approved for?

Personal loans from online lenders are usually the easiest, especially for those with fair credit.

3. How much income is required for a personal loan?

There is no specific amount, but stable, consistent income improves approval chances.

4. Can I get a personal loan without a job?

Yes, if you have alternative income sources like benefits, investments, or rental income.

5. Do personal loans affect my credit score?

Yes. Payments reported to credit bureaus can raise or lower your score depending on how you repay.