Introduction to Loans in the USA

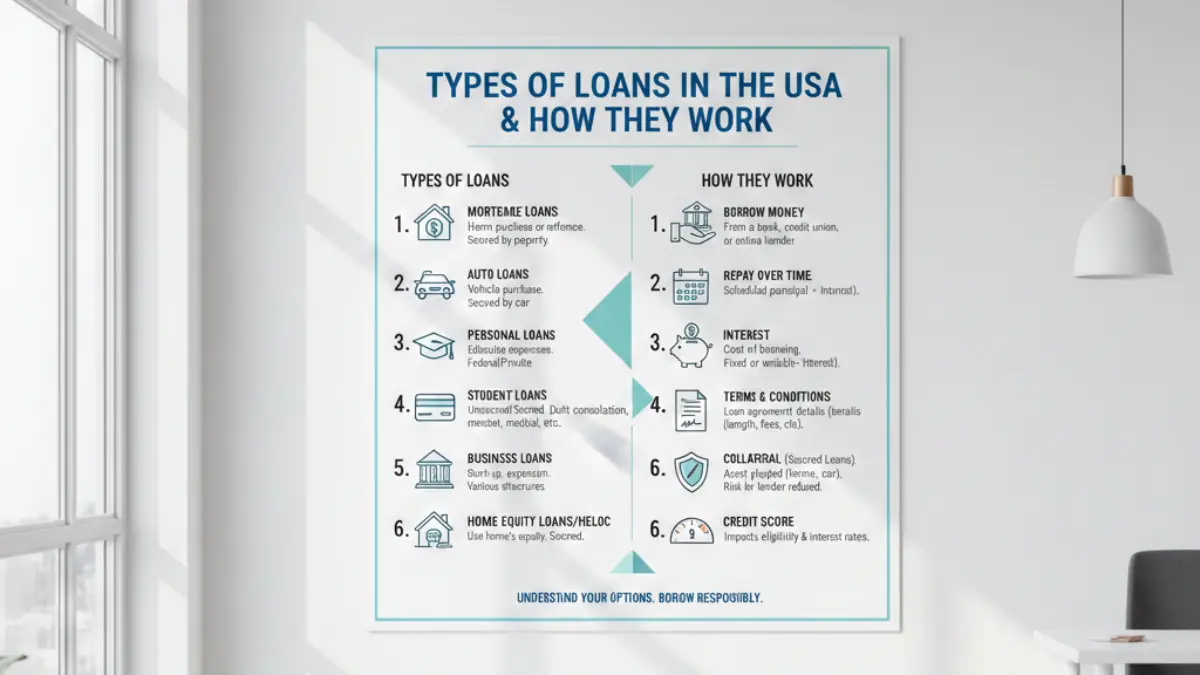

Loans play a major role in helping people achieve big financial goals—whether buying a home, paying for college, or starting a business. When you borrow money from a lender, you agree to repay it over time with interest. Sounds simple, right? But the loan world is much bigger than it seems. Different loans serve different purposes, and each has its own rules, benefits, and risks.

Secured vs. Unsecured Loans

Secured Loans Explained

Secured loans require collateral—an asset the lender can take if you don’t pay. Common examples include mortgages and auto loans. Because the lender has protection, secured loans usually offer lower interest rates.

Unsecured Loans Explained

Unsecured loans don’t require collateral. Lenders rely on your credit score and income instead. Common examples include personal loans and credit cards. Since they’re riskier for lenders, interest rates are usually higher.

Key Differences and Examples

- Secured: Auto loans, mortgages, home equity loans

- Unsecured: Personal loans, student loans, credit cards

Mortgage Loans

How Mortgage Loans Work

Mortgage loans help you buy a home without paying the full amount upfront. You repay monthly over 15 to 30 years, including interest and taxes.

Fixed-Rate vs. Adjustable-Rate Mortgages (ARMs)

- Fixed-rate: Same interest rate throughout the loan

- ARM: Interest rate changes based on market conditions

Government-Backed Mortgages

- FHA: Low down payment, good for first-time buyers

- VA: Available to veterans with zero down payment

- USDA: For rural homebuyers with little to no down payment

Auto Loans

Financing a New vs. Used Vehicle

New cars usually get lower interest rates but higher prices. Used cars are cheaper but may have higher rates.

Loan Terms & Interest Rates

Auto loan terms normally range from 36 to 72 months. Longer terms mean lower monthly payments but more interest overall.

Impact of Credit Score

Higher credit scores get better rates. A good score can save thousands of dollars over the life of the loan.

Personal Loans

When to Use a Personal Loan

People use personal loans for emergencies, home repairs, debt consolidation, or major purchases.

Secured vs. Unsecured Personal Loans

Secured personal loans require collateral, but most personal loans in the USA are unsecured.

Loan Terms

Terms range from 1 to 7 years, with interest depending on credit score and lender policies.

Student Loans

Federal Student Loans

Offered by the government with fixed interest rates and flexible repayment plans.

Private Student Loans

Provided by banks or private lenders, often with variable interest rates.

Subsidized vs. Unsubsidized

- Subsidized: Government pays interest while the student is in school

- Unsubsidized: Interest starts accumulating immediately

Credit Card Loans

How Revolving Credit Works

Credit cards give you a credit limit to borrow from repeatedly. You only pay interest on the amount used.

Interest Rates

Usually high, often 18% to 30% APR.

Balance Transfer Loans

These allow you to transfer high-interest debt to a 0% interest card for a promotional period.

Business Loans

SBA Loans

Backed by the Small Business Administration, these loans offer low rates and long repayment terms.

Business Lines of Credit

Borrow only what you need, and pay interest on the used amount.

Startup Loans

Designed for new businesses but often require strong credit or collateral.

Payday Loans

How They Work

Payday loans offer quick cash until your next paycheck. They’re easy to get but come with extremely high interest rates.

Risks

APR can exceed 300%, trapping borrowers in a cycle of debt.

Safer Alternatives

- Credit union loans

- Personal loans

- Borrowing from friends/family

Home Equity Loans & HELOCs

How Home Equity Loans Work

Borrow a lump sum using your home’s equity. Repay with a fixed interest rate.

How HELOCs Work

A Home Equity Line of Credit works like a credit card backed by your home.

Key Differences

- Home Equity Loan: Fixed amount

- HELOC: Flexible borrowing

How Loan Interest Works

Simple Interest

Interest calculated only on the principal.

Compound Interest

Interest calculated on principal + accumulated interest.

APR vs. Interest Rate

APR includes fees, giving a clearer picture of loan cost.

How to Qualify for a Loan

Credit Score Requirements

Most lenders want a score of 650+, but requirements vary.

Income & DTI Ratio

Your Debt-to-Income ratio shows how much of your income goes toward debt. Lower is better.

Collateral & Documentation

Lenders may require proof of income, employment, and assets.

Tips for Choosing the Right Loan

Comparing Lenders

Don’t choose the first offer—compare interest, fees, and terms.

Checking Loan Terms

Look for penalties, extra charges, and repayment flexibility.

Avoiding Scams

Avoid lenders who guarantee approval or charge upfront fees.

Conclusion

Loans can open doors to big opportunities—buying a home, starting a business, or paying for education. But understanding how they work is essential to avoid costly mistakes. By knowing the different types of loans and how lenders evaluate borrowers, you can choose the loan that fits your goals and financial situation. Always compare options, check interest rates, and make sure the loan aligns with your long-term plans.

FAQs

1. What is the most common type of loan in the USA?

Mortgage loans are the most common because most Americans use financing to buy homes.

2. Which loan is easiest to get?

Personal loans and credit cards are easiest, but payday loans require almost no verification.

3. How does my credit score affect loan approval?

A higher score means better chances of approval and lower interest rates.

4. Are government loans better than private loans?

Government loans usually offer better terms, lower interest, and more protections.

5. What loan has the highest interest rate?

Payday loans have the highest rates, sometimes exceeding 300% APR.